Co-buying & Co-owning a Home 2025 Report

The state of home co-ownership in the US in 2025. Explore trends, challenges, and insights from our survey and report on co-buying and shared homeownership.

Introduction: A Movement, Not a Trend

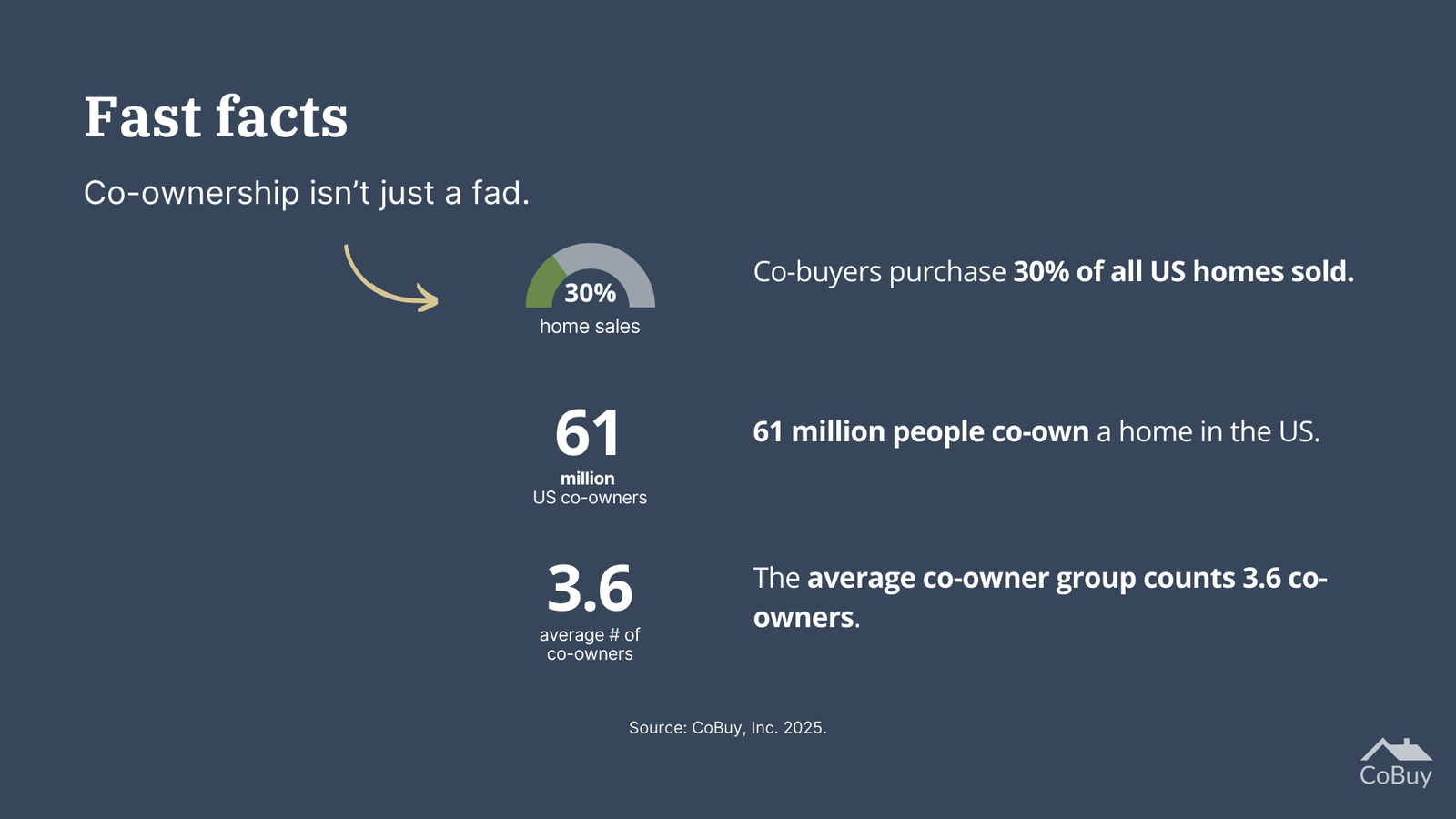

In 2025, over 61 million Americans co-own a home1 with someone who isn't their spouse—nearly 20% of the population.

Co-buying and co-ownership aren’t just alternatives; they’re essential paths to modern homeownership. Today, 30% of all US home sales are to co-buyers²—a transformative shift in how Americans approach housing.

We started CoBuy back in 2016 because we lived this ourselves. We saw the gaps, the frustrations, and the risks firsthand.

Co-ownership offers an accelerated path to wealth creation, but without proper tools, it can become a minefield of financial, relational, and legal challenges. On average, co-owner groups say they need help with six major aspects of managing joint homeownership.

This report builds on years of data to explore those challenges, the progress made, and how we can collectively unlock the full potential of co-ownership.

The Co-ownership Journey

Buying a home with others is rewarding, but it isn’t simple. Co-ownership is a shared investment, a social contract, and a financial partnership—all at once. Without a plan, it can become overwhelming.

Here’s how the journey unfolds:

- Co-buying: The initial purchase.

- Co-ownership: Day-to-day management of the property and relationships.

- Exit: The eventual sale, transfer, or dissolution of the arrangement.

This journey demands a proactive, collaborative approach. And yet, many co-buyers go in unprepared.

The 6 Core Challenges

From our survey of 1,637 co-buyers and co-owners across all 50 states, we identified six universal pain points. These challenges affect everyone, no matter the group size or makeup.

1. Co-ownership Agreements (94% Need Help)

A Co-ownership Agreement is the #1 thing co-owners say they need help with—and it’s no surprise. It’s not just about having a document; it’s about aligning on decisions, expectations, and safeguards.

The Risks of Neglecting an Agreement:

- Misaligned expectations lead to disputes.

- Financial losses from unresolved disagreements.

- Legal risks when issues arise.

The Solution: Co-ownerOS™ helps you create dynamic agreements tailored to your group’s unique goals, evolving with you and your lives over time.

Read: Why Every Co-owner Needs a Tailored Agreement.

2. Finances, Expenses, and Payments (69% Need Help)

Money is one of the most common sources of tension in any relationship. For co-owners, the stakes are even higher. Disagreements over unexpected costs or financial contributions can quickly escalate without a framework in place.

Why Financial Literacy Matters: According to the World Economic Forum, financial literacy in the U.S. has hovered around 50% for eight years, with a 2% decline recently. The PFIN Index highlights risk comprehension as a key weakness, which is critical for navigating joint investments like co-ownership. Without this understanding, co-owners are more likely to encounter financial mismanagement and conflict.

The Fix:

- Agree on recurring and non-recurring expenses upfront.

- Establish shared reserve accounts for emergencies.

- Use Co-ownerOS™ to navigate contributions and expenses transparently.

Discover: Hidden Costs of Co-ownership: Avoid $765,000+ in Risks.

3. Documentation and Record-Keeping (66% Need Help)

In co-ownership, staying on top of paperwork isn’t optional—it’s essential. From purchase agreements to insurance policies, keeping records centralized protects everyone.

Why It Matters:

- Helps resolve disputes quickly.

- Essential for tax filings, refinancing, or selling.

- Reduces stress when unexpected issues arise.

Co-ownerOS™ provides a secure, accessible space to store and manage all your key documents.

Explore: Co-owner's Guide to Documentation & Record Keeping.

4. Roles, Rights, and Responsibilities (66% Need Help)

Co-owners often assume they’ll "figure it out as they go." But without clear roles, misunderstandings—and conflicts—are inevitable.

Key Questions:

- How are decisions made?

- Who handles maintenance and bills?

- What happens when someone falls short of their responsibilities?

Pro Tip: Define these roles early. Use Co-ownerOS™ to keep everyone accountable and aligned.

Learn: 5 Co-owner Flashpoints Around Roles, Rights, & Responsibilities.

5. Exit Strategies (63% Need Help)

Every co-ownership arrangement will end, whether through sale, transfer, or unforeseen circumstances. Without a plan, exits can become messy and expensive.

Why It’s Critical:

- Protects your financial investment.

- Minimizes disputes and legal fees.

- Provides peace of mind for all parties.

Plan: How to Create Your Co-ownership Exit Strategy.

6. Risk Protection (59% Need Help)

Most co-owners underestimate the risks they face—from financial to legal. Building safeguards into your arrangement reduces these risks significantly.

Proactive Measures:

- Insurance (Homeowners, Title, Life, Umbrella, etc.).

- Regularly updated agreements.

- Transparent financial planning and management.

Key Insight: As co-ownership grows, so does awareness of risk. This year, 59% of co-owners reported needing help with risk protection, up from 56% last year. Tools like Co-ownerOS™ make it easier to stay ahead of potential challenges.

Safeguard: Manage Risks in Co-buying & Co-ownership.

📱 Take control of Co-ownership with Co-ownerOS™

Co-ownerOS™ provides the tools you need to simplify co-ownership, protect your investment, and stay aligned.

Join Co-ownerOS™ Beta today →

Spots are limited.

Who Co-owns Homes?

There’s no “typical” co-owner.

Co-ownership attracts a broad range of people united by shared goals but diverse in their backgrounds. This year’s data reveals:

- Age: Co-owners range from their mid-20s to their 90s, highlighting co-ownership's appeal across different life stages and goals.

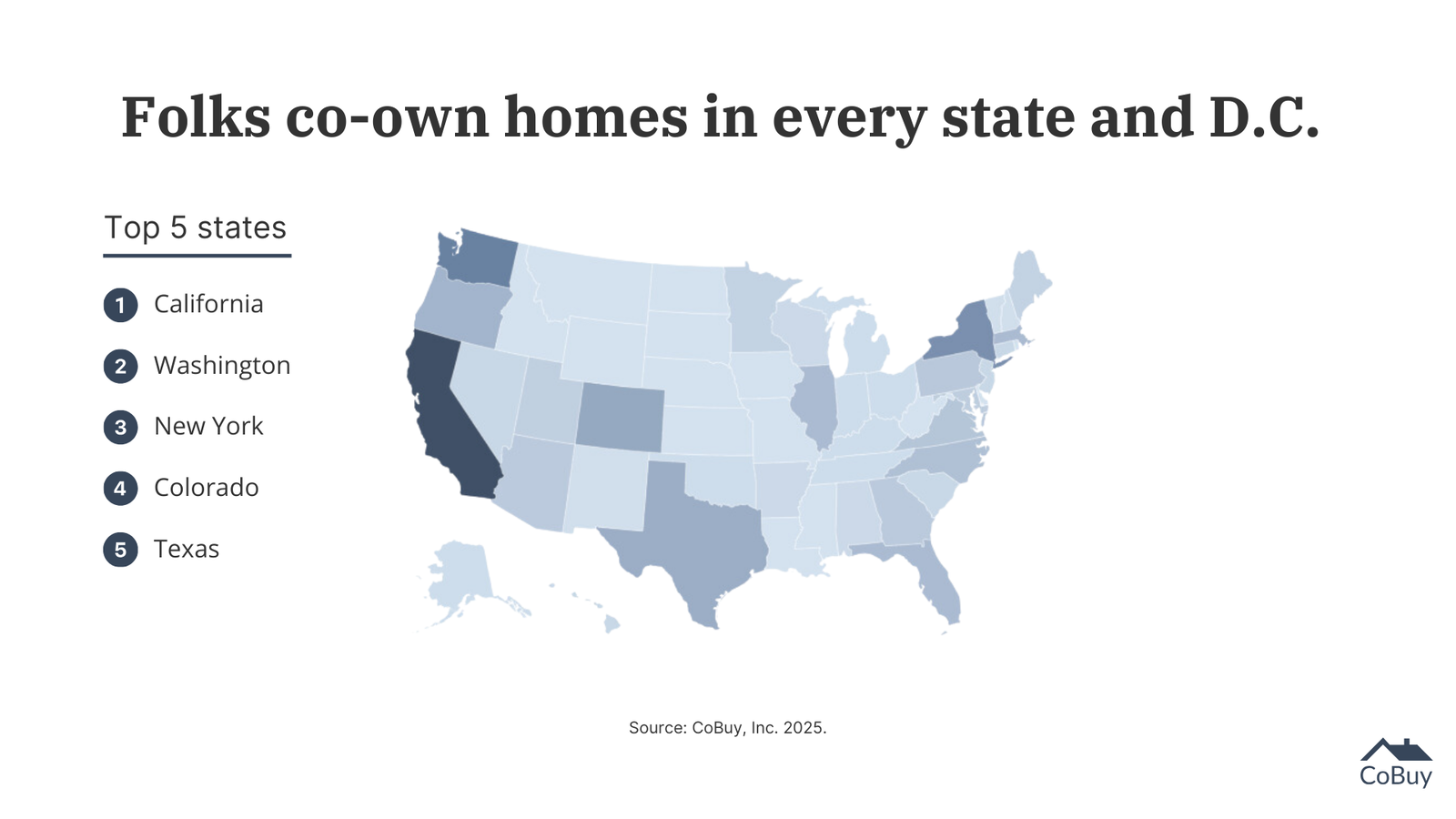

- Geographies: Co-owners are represented in all 50 states and the District of Columbia, spanning urban, suburban, and rural areas. A moderate shift toward higher concentrations in Coastal Metros reflects rising home prices over the past 12 months.

- Group Composition: Friends make up the largest segment (58%), followed by relatives (30%) and unmarried couples (23%). Mixed groups—comprising friends, relatives, or other combinations—account for 31% of all groups, and 15% of groups include a married couple.

- Group Size: The average co-owner group size increased to 3.6 this year, up from 3.3 in 2024, signaling a trend toward larger and more varied co-owner groups.

Unsurprisingly, the top two motivators behind the decision to co-own remain:

- Financial reasons

- Social reasons

What’s Next for Co-ownership?

1. Multi-Generational Living Redefined

Economic pressures and cultural shifts are driving a surge in multi-generational households. Over 65 million Americans now live in multi-generational homes3, a figure expected to rise as Baby Boomers age and Millennials prioritize family ties.

Co-ownerOS™ empowers families to create clear, flexible agreements that address contributions, responsibilities, and generational needs.

2. Co-ownership as Financial Strategy

With 30% of U.S. homes purchased by co-buyers², shared ownership is no longer a fallback—it’s a wealth-building strategy for millions.

Co-ownerOS™ turns shared ownership into financial advantage through transparency, knowledge, and alignment to maximize value for all parties.

3. Technology Unlocking New Possibilities

Digital platforms like Co-ownerOS™ are revolutionizing co-ownership, reducing friction and empowering better management.

Emerging tools like blockchain and AI are poised to redefine co-ownership. Blockchain ensures secure agreements with tamper-proof records, while AI provides personalized insights to help co-owners plan, budget, and stay aligned. These innovations represent the next frontier in simplifying and empowering co-ownership.

4. The Rise of Fixed-Term Ownership

Fixed-term co-ownership is becoming a popular choice for friends and unmarried couples looking to build equity together without long-term commitments.

Co-ownerOS™ helps groups establish clear terms for ownership duration, enabling smooth transitions and reducing conflict when it’s time to move on.

The Bottom Line

Co-ownership is no longer a fringe trend—it’s reshaping how Americans access and manage homeownership. From friends pooling resources to multi-generational households, shared ownership offers financial opportunity and lifestyle flexibility.

But it comes with challenges: agreements, finances, risk protection, and more. Without the right tools, these obstacles can create stress and conflict. That’s where Co-ownerOS™ comes in.

Co-ownerOS™ simplifies co-ownership by providing the structure, tools, and insights you need to succeed—whether you’re just starting or navigating long-term responsibilities. From dynamic agreements to financial management and exit strategies, we help you stay aligned and protected.

📱 Ready to Simply Co-ownership?

Join Co-ownerOS™ Beta today and take control of your co-ownership journey. Spots are limited—don’t wait.

Join Co-ownerOS™ Beta today →

FAQs

What’s the definition of a co-buyer/co-owner?

A co-buyer is anyone who collaborates with others to purchase a home, including friends, family, or partners. Once the purchase is complete, they become co-owners, sharing legal ownership of the property.

Anyone who isn’t on Title–children, dependents, renters–isn’t considered a co-owner as they don’t have a legal ownership interest in the home.

What types of groups are best suited for co-ownership?

Co-ownership works for a wide range of friends, relatives, and loved ones. The key is alignment on goals, contributions, and expectations. Groups with clear communication and a shared vision are best suited to succeed. Co-ownerOS™ helps any group stay aligned and organized.

How does co-ownership impact taxes and shared expenses?

Co-ownership impacts shared expenses like property taxes, maintenance, and utilities. A clear plan is essential to avoid conflict. Tools like Co-ownerOS™ help co-owners track contributions, manage payments, and simplify tax filings.

What are the biggest challenges co-owners face after purchase?

After purchase, co-owners often face challenges like unclear roles or unexpected expenses. A proactive approach with clear agreements and financial tracking reduces strain and conflict.

Notes

1 Estimate based on data from US Census Bureau ACS, US Consumer Financial Protection Bureau HDMA, CoBuy, Inc.

2 Estimate based on data from US Census Bureau ACS, US Consumer Financial Protection Bureau HDMA, ATTOM Data, NAHB, CoBuy, Inc.

3 Households including two or more adult generations living under one roof. Estimate based on data from US Census Bureau ACS, Pew Research, CoBuy, Inc.

Survey Methodology

In a comprehensive 2025 study on home co-ownership, CoBuy, Inc. surveyed US groups of co-buyers and co-owners comprising 1,637 adults from 50 states and Washington, D.C. Groups included friends, relatives, and couples falling into one of two categories: (1) co-buyers who plan to jointly purchase a home within the next 24 months or (2) co-owners who currently share ownership interest in a residential property. Participants responded to both open and closed-ended questions.

Fair Use

If you'd like to feature, reference, or reproduce any portion of this report or its contents, you have our permission subject to clear attribution to CoBuy and a dofollow link to either https://www.cobuy.io or this page's URL.

Questions, Comments, Media Inquiries

Get in touch with us at research [at] cobuy.io.